Fixed income products like bank fixed deposits or post office schemes have traditionally been one of the preferred investment options among retired people in India. Upon receiving retirement benefits like provident fund or gratuity, most retired people invest a good chunk of it into such instruments.

Bank FDs are widely considered to be safe & convenient, and they provide a steady stream of interest payments irrespective of market or economic conditions. Also, many retired individuals in India do not have the proper awareness of other investment instruments & it is difficult to find an expert to guide them as well.

But what happens when you park your entire retirement corpus in instruments like bank FDs and plan to use the interest payments to cover your expenses after retirement?

To answer this question, we need to first understand how our expenses change over time. Generally, our expenses tend to increase year after year – this is called Inflation. Normally the rate of inflation in the Indian economy has been 5-8% over the long-term. In the last few years, you may have noticed an increase in the prices of common everyday items like vegetables, milk or petrol.

After retirement, even if your spending needs are modest, your expenses continue to rise each year. Over a 20-25 year timeframe, inflation may cause your expenses to rise by 4-5 times from today’s levels. Further, inflation tends to be even higher for services like health care that you may need more after retirement.

However, the interest income generated from bank FDs (or any similar fixed return instrument) is fixed – though it may fluctuate slightly due to the level of interest rates in the economy, it will not increase the way that your expenses increase due to inflation, creating a widening gap between your income & your expenses over time.

Let’s look at an example of Ms. Srinivasan, who lives in Chennai – she has just retired with a total retirement corpus of Rs.1 crores and annual expenses of Rs.5 lakhs. At the time of retirement, she was not aware of other options, so she invested all her wealth in the form of Bank FDs, earning an interest of 7.5% per annum

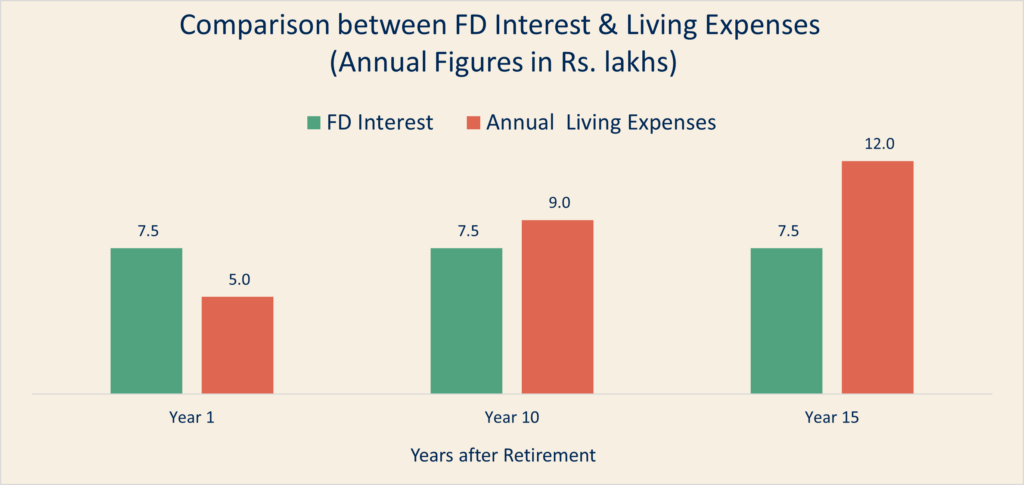

In the first year after retirement, her bank FDs gave her an interest income of 7.5 lakhs, while her expenses were only Rs.5 lakhs. In the 11th year after retirement, assuming 6% inflation, her expenses increased to around Rs.9 lakhs, while the bank interest earned by her remained at Rs.7.5 lakhs annually. This was a gap of 16% between her income & expenses – which she easily bridged by reducing her expenses on travel & entertainment.

However, in the 15th year after retirement, the problem became dire – her expenses had increased further to Rs.12 lakhs, while her bank FD interest remained at Rs.7.5 lakhs. She was now finding it difficult to meet her expenses and had no choice but to ask her children for help.

This is a common scenario that plays out for many retired individuals across the country, who initially cut their expenses and then later are forced to seek help from children or make uncomfortable cuts in living expenses. The only way to avoid this is to invest part of your retirement corpus in instruments that can help you beat inflation, such as equity mutual funds, NPS, stocks, gold etc.

If you are unsure how to build such an inflation-beating portfolio, you can seek the help of a financial advisor or a company like Mighty to help you invest your retirement benefits. We will do a detailed assessment of your finances to help you construct the best possible retirement portfolio that beats inflation for a long period of time.