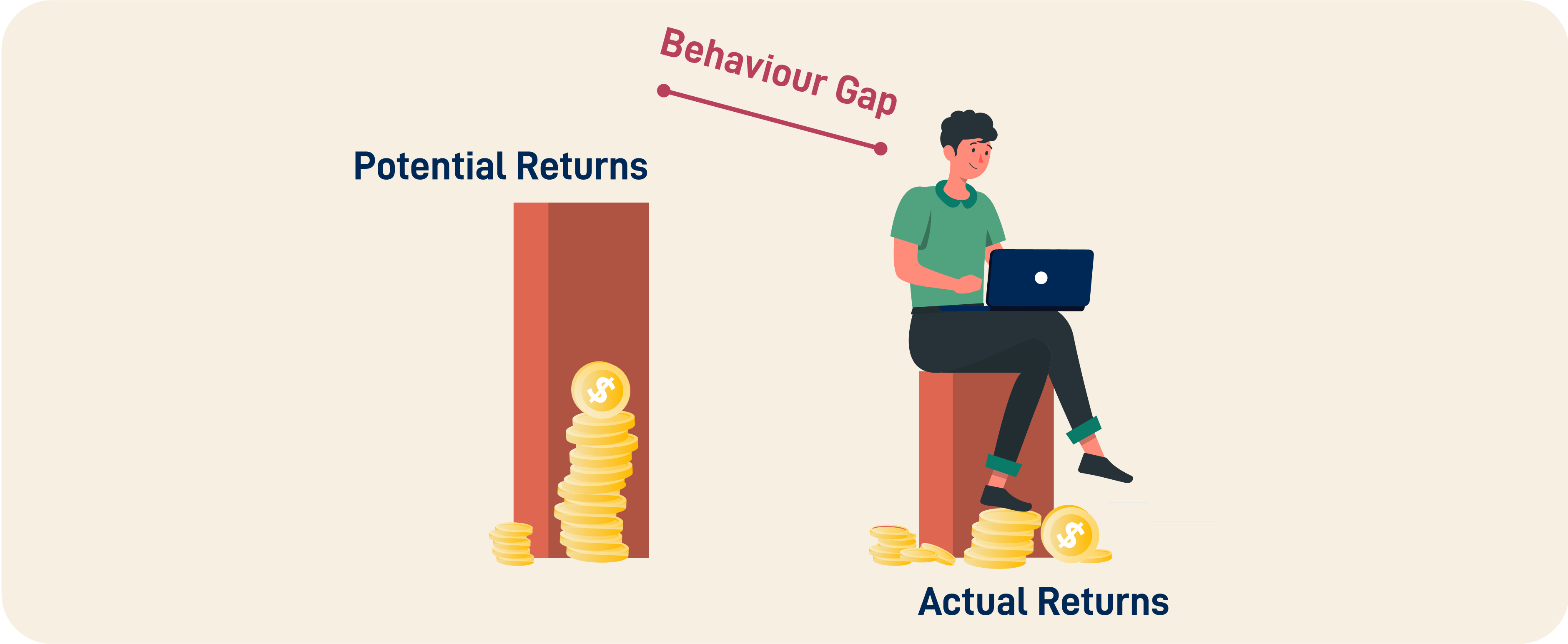

The term ‘Behaviour Gap’ was coined by American financial planner Carl Richards in his 2012 book. It refers to the difference between the potential returns we can earn if we just passively hold our investments and the actual returns we earn by actively getting in and out of our investments. It shows that on average a lot of actions taken by people are suboptimal, driven by emotions and feelings rather than sound reasoning.

In 2022, financial research firm Dalbar published its study ‘Quantitative Analysis of Investor Behavior’ based on the U.S. market, which analysed the effect of investors’ active decisions on investment returns. From 1992 to 2021, the average U.S. equity fund investor underperformed the S&P 500 by 3.5%. This difference arises from poorly timed buy & sell decisions as well as costs incurred in switching between investments.

A similar study was performed recently by Axis mutual fund in India, analysing investor returns over the last the last 20 years (2003-2022). On an average, an Indian equity mutual fund investor has underperformed the respective fund by 5.3%. The figure is higher than the U.S. markets probably because of the greater volatility in the Indian markets historically compared with the U.S., which reduces investor’s ability to stay invested over a long period of time.

What is affecting your Behaviour?

We all suffer from emotional biases – feeling fear and greed at various points in our investment journey. Fear refers to the fear of losing money – it keeps you from benefiting from the long-term average positive return of the market. Greed refers to the greed to earn higher returns, causing you to enter the market or increase your exposure after a prolonged period of good returns. Both emotions are problematic for different reasons – the best way out is to either follow a passive approach or use a well-tested quantitative system to guide your behaviour. Taking actions solely based on your feelings will lead to repeated mistakes.

Another common issue is ‘Overconfidence Bias’, where you overestimate your abilities, thinking you have some unique insight into markets, whereas you actually don’t. You may remember some past examples where you made good investments and therefore believe that you are a superior investor that can ‘beat’ the market all the time. A good way to remedy this is to track your portfolio performance against a broad index like the Nifty 50, which will clearly show you that it is difficult to beat index returns for most of us.

What should you do to make better decisions about investments?

The financial markets are inherently uncertain and you can’t make perfect decisions every time. One way to avoid bad decisions is to minimize the number of actions you take – Warren Buffet, the ace investor, said that each of us will have much better outcomes if we operate as if we only have 20 opportunities to invest in our lifetime.

Learning more about investing and money can also help you avoid common mistakes – you can look at personal finance books or apps that provide structured financial content and make informed decisions about your money. If you don’t have time, you can achieve similar results with the help of a good financial advisor who will take over these decisions on your behalf.