ELSS (Equity Linked Saving Scheme) is a type of mutual fund scheme that offers an income tax exemption of upto Rs.1.5 lakhs annually under Section 80C of the Income Tax Act. These schemes are required to invest over 80% of assets into equity investments and they have a 3 year lock-in period from the date of investment.

Investors think of ELSS funds only as a tax saving option, often ignoring the psychological benefit of the lock-in period. Due to the lock-in, you stay invested for longer and increase the probability of getting an attractive return. In spite of this, ELSS funds are the most liquid among the various tax saving instruments such ULIPs/Tax-saving FD/NSC (5 years), PPF (15 years), EPF & NPS Tier 1 (until retirement).

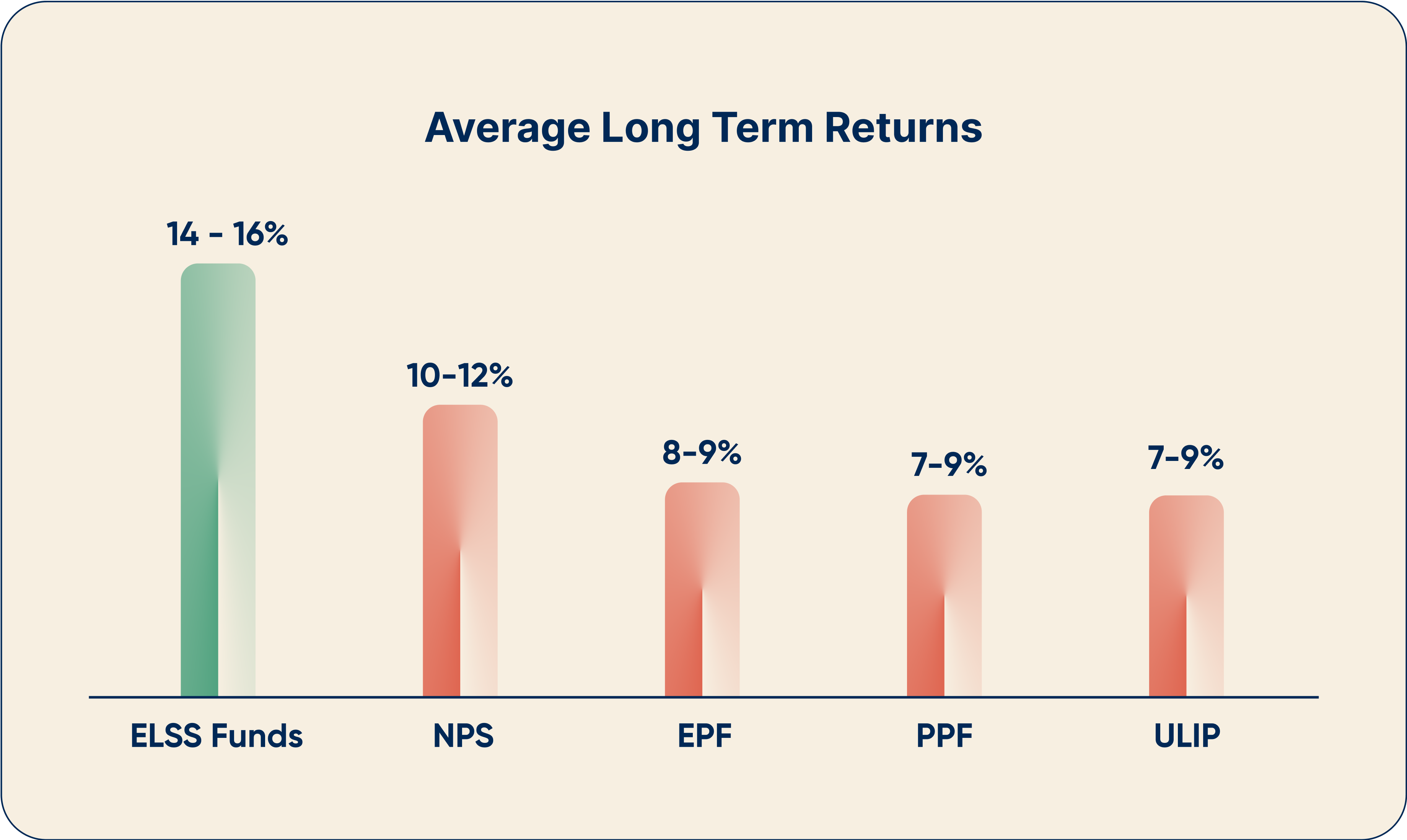

Because of their 80-100%+ equity market exposure, ELSS funds generate returns superior to all the other tax-saving investments like PPF, ULIP, EPF, SSY, NSC etc. which have generated 7-9% annual returns. The top five ELSS funds have generated an average 3-year rolling return of 15.4% over the last 12 years.

Mighty has closely analysed the 30+ ELSS funds available today and picked the best ones for you to invest. Invest now and save up to Rs.46,800 per year!