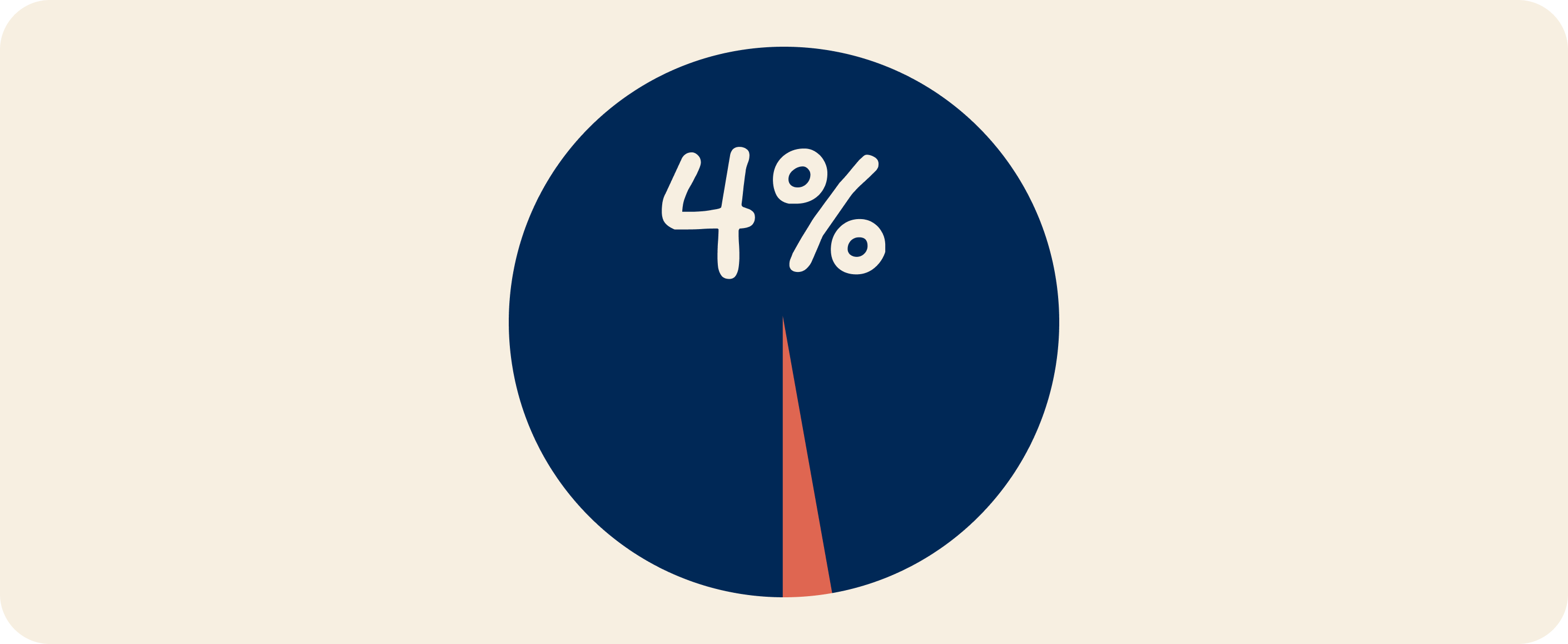

In the 1990s, American financial advisor William Bengen conducted research on retirement planning and found ‘the 4% rule’, according to which you can safely withdraw 4% of your corpus in the first year of retirement and increase it annually according to inflation. Put differently, you need to have set aside around 25 times your annual expenses at the start of your retirement to be able to retire safely.

There are several underlying assumptions made to reach this 4% figure. First, you will not grow your annual spending beyond the rate of inflation after retirement. For example, in the 2nd year, if the inflation is 5%, you will withdraw 5% higher than the first year for expenses. In the 3rd year, if inflation is only 3%, you will withdraw 3% higher than the second year and so on. Second, your retirement portfolio should have 50% exposure towards equities and rest in bonds. Third, the rule was developed so that your retirement corpus should last at least 30 years. Lastly, the calculations don’t include the taxes and any fees you pay to manage your money.

After studying several decades of historical data on investment returns & inflation with different withdrawal rates, Bengen found that 4% was the optimal rate as most portfolios lasted 50+ years at this rate. A common mistake people make is to actually withdraw 4% of the portfolio every year, irrespective of the inflation rate – this could deplete your portfolio faster than 30 years.

Let us understand this rule with an example: Assume you are starting your career at 25 and plan to retire by the age of 55. Let’s say you are spending Rs 40,000 monthly on your expenses currently. Assuming an inflation of 5% for 30 years, you would spend Rs 1.72 lakhs monthly (Rs 20.7 lakhs annually) when you retire assuming an inflation of 5% for 30 years. Hence you would need a retirement corpus of nearly Rs 5.2 crore (Rs 20.7 lakhs x 25 times) by the time you retire. In year 1, you would be withdrawing Rs 20.7 lakhs (4% of Rs 5.1 crore), followed by Rs 21.8 lakhs in year 2 (adjusting for inflation of 5%).

Despite being a simple rule of thumb, it is a good guideline in most environments for the US market. For countries such as India, as inflation and interest rates are higher, a higher withdrawal rate of 4.5-5% is more appropriate, which means a corpus of 22.5-20 times your annual expenses at the start of retirement. In the above example, a corpus of Rs 4.6 crore (Rs 20.7 lakhs x 22.5) would be enough. Also, if you have a skilled financial advisor or an app that provides financial guidance, you may be able to earn returns better than the conservative 50:50 portfolio used by Bengen, which could help you reduce this figure even further.

As careers evolve in the modern era, most people may not work until the traditional retirement age of 60, but may choose to retire from full-time work earlier and earn income through a range of part-time work and side-gigs. In these cases, the 4% rule can be used as a guide to choose when you can retire fully. For example, say you have accumulated 20 times your annual expenses as a corpus by the age of 45 and can build up the rest with either 3 years of full-time work or 7 years of part-time work. Many people may choose the latter due to higher flexibility and freedom.

There are some special cases, where this rule may not work – for example, if you face huge losses on your retirement corpus in the first few years of your retirement. Sequence of Returns risk is the name for this issue – when the early years of your retirement concur with a period of significant market underperformance which leads to a drop in your corpus. The best way to mitigate such a risk is to be flexible with your expenses so that you can lower your withdrawal rate for a few years until your portfolio recovers – for example, lowering your withdrawals by 20% for 5 years can help you catch up after a 10% unexpected drop in your portfolio.