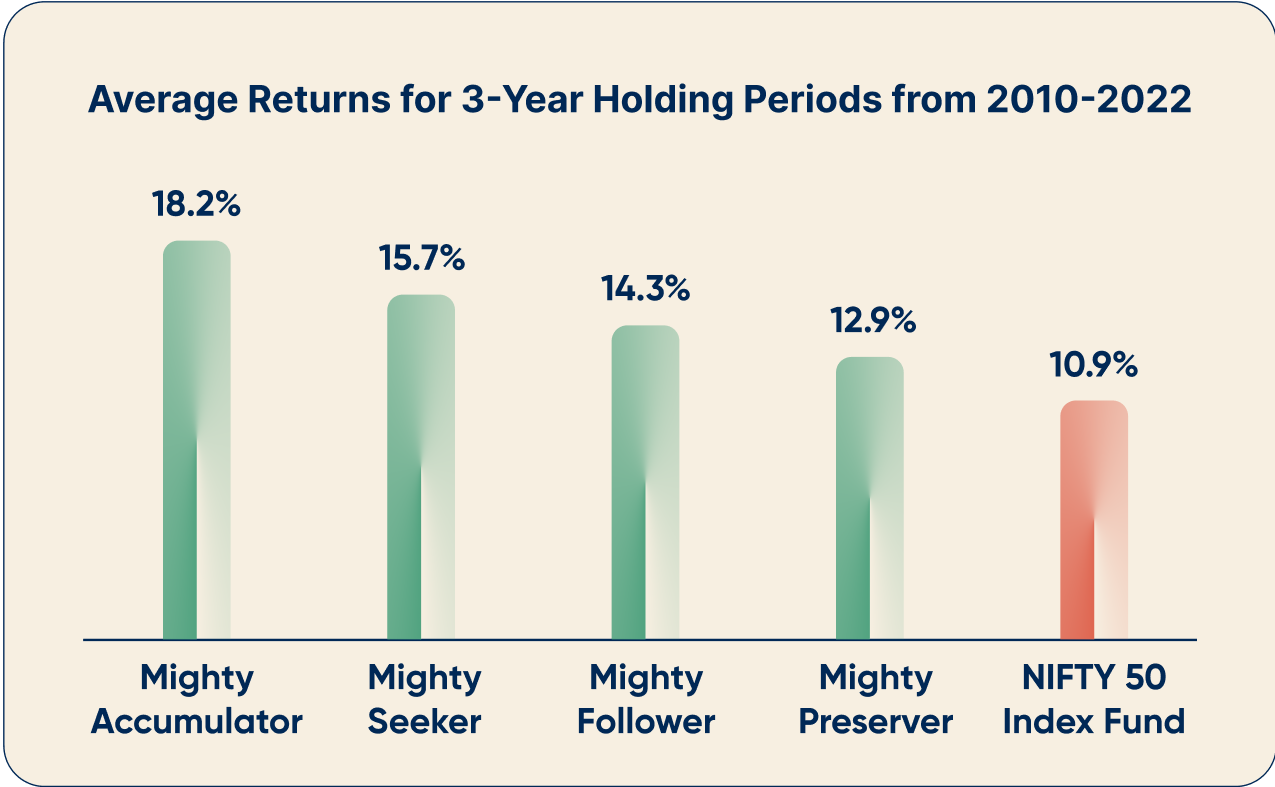

In recent years, investing in large cap passive products like a NIFTY 50 Index Fund has been held up by some as the holy grail of investing – in our research, we find that using multiple asset classes and rule-based periodic rebalancing generates better returns with lower downside risk than such an index fund, as seen in the chart above. Further, using a strict quantitative rule-based system can help investors overcome their basic human biases of fear, overconfidence and greed.

Your portfolio should fit you; hence we learn about your risk preferences and goals and offer you a customised portfolio. Our risk survey uses the Nobel-prize winning Prospect Theory in a game-like format & the questions are customised to your level of income. Each of our risk-based portfolios offers a different risk-return combination. By matching you to a portfolio whose ups & downs you can handle, we make it more likely that you will stay invested for the long term.

All our recommendations are backed by rigorous quantitative research – our asset-allocation research is based on 27 years of data and our fund selection is based on 10+ years of data for most categories. We do not follow theoretical frameworks like 60:40 Equity:Debt; instead we have used original research to find exactly what works best for the Indian retail investor at various levels of risk.

We use mutual funds to construct our portfolios as they are highly diversified, well-regulated and liquid products that let you benefit from the expertise of experienced fund managers at a low cost. Our portfolios consist of a combination of 6-7 mutual funds, diversified across asset classes i.e. Indian stocks, US stocks, Debt and Gold. Within each of these asset classes, we have chosen the best funds that have performed consistently in their category.